Originally Posted Oct 5, 2022 The PAXAFE team recently had a blast meeting with old friends and...

The Future of Cold Chain Visibility (LogiPharma EU 2023 Recap)

Originally Posted May 2, 2023

Last October, I had posted my synopsis on the direction that the cold chain visibility industry was heading.

Just a mere 7 months later, we sit here validating a number of those projections right in front of our very eyes.

The PAXAFE team has just returned from Lyon, France where we’d attended LogiPharma’s Life Sciences conference.

We’d met with old friends and new. We did panels and exchanged thought leadership. And, of course, we ate local cuisine.

Here are my top 5 takeaways from LogiPharma France 2023:

ONE: AI is expediting the rate of change and scope of possibilities with regards to real-time visibility

Pharma 5+ years ago: Real-time IoT will only be used on high-value / high-problem lanes

Pharma 12–24 months ago: Real-time IoT will be used on a majority of my lanes & shipments

Pharma today: I want my real-time IoT data to automate my workflows, quantify my lane risk, simulate my shipping scenarios and optimize my packaging

Case in point…

Do you know how many ‘lane risk’ or ‘resiliency’ platforms we saw 6 months ago at LogiPharma Boston, other than PAXAFE? Possibly 1 or 2, where risk management was a byproduct of another primary offering.

Do you know how many we saw this conference? At least 8. And not just new entrants. Large incumbent service providers that have been around for decades are also jumping to show off their latest risk offering mockups.

TWO: Risk management has jumped to the forefront of relevancy, closely followed by sustainability

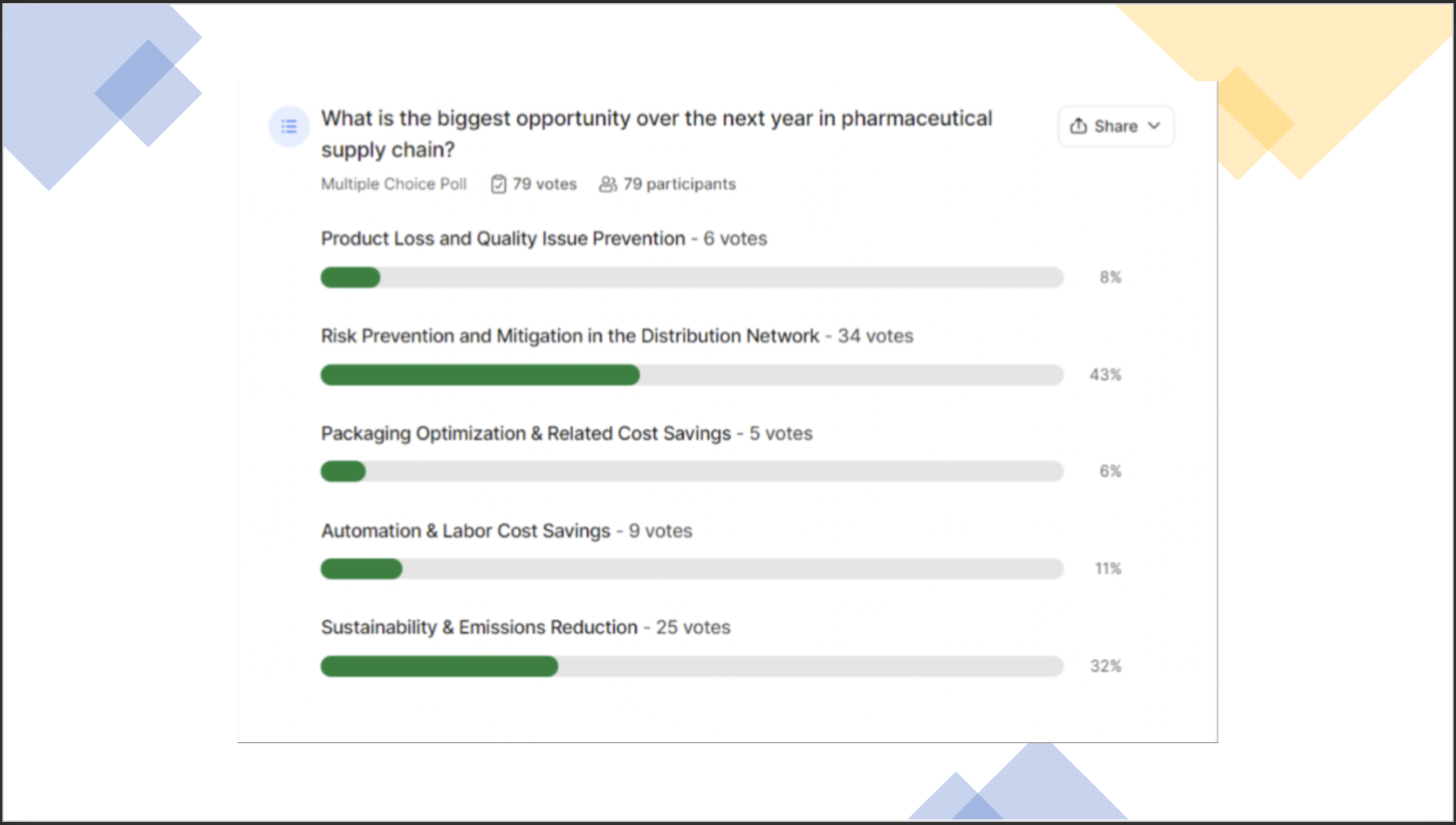

We asked the question: "What is the biggest opportunity over the next year in the Pharmaceutical supply chain?"

43% of the audience responded: “Risk Prevention and Mitigation in the Distribution Network”

32% said: “Sustainability & Emissions Reduction”

“Automation / labor cost savings,” “product loss reduction” and “packaging optimization” rounded out the bottom 3 answers, respectively.

This should not be a surprise. Let’s explore how the industry currently quantifies their lane and network risk:

— Step 1: engage a service provider to attach real-time IoT sensors to a specific lane for a fixed period of time (e.g. 3 months)

— Step 2: pay hundreds of thousands of dollars and wait 3 months for data to come in

— Step 3: Analyze the data manually, particularly trying to extract trends between location, temperature and delays

— Step 4: That fixed term data becomes static data, and doesn’t account for seasonality, carrier or IoT selection, route selection, extraneous events (e.g. Covid), weather disruptions, port congestion, etc.

…but that static dataset becomes the lane risk source of truth for the foreseeable number of years. And network decisions with real consequences are made based on data that doesn’t accurately reflect what is actually happening on the lane.

And this beautiful, antiquated process is what we call lane mapping.

This entire exercise can now be done with one quick API integration. And instead of relying on a static dataset, each incremental IoT shipment dynamically updates your universe of routes and waypoints and corresponding lane risk score, accounting for and showing the exact risk variables that are being impacted on the lane and why.

THREE: Big Pharma is betting on CAR-T and cell & gene therapies

There are still just a limited number of approved therapies put forth by those leading the cell & gene therapy charge in Pharma; companies like Janssen, BMS and Novartis.

These therapies are expensive to produce, transport and consume.

In part, this is due to the fact that handling and controlling cells is more complicated than handling chemicals. Additionally, while traditional biopharmaceuticals are typically made to be consumed by hundreds of thousands or millions of patients, cell & gene therapies are significantly lower volume — often times being made for dozens, hundreds or thousands of patients.

Production and demand variables drive price up, valuing the cost of each dose (on average) to be $1–$2M.

This places an immense amount of pressure on LSP transport and handling. The risk of losing or rendering ineffective a single dose is not just an expensive economical proposition, but can more importantly impact patient safety and treatment.

LSPs will need to continue to invest in risk mitigation pertaining to the end-to-end cold chain handling of these sensitive therapies.

FOUR: Hardware providers are duking it out on the battlefield: the race to operationalize the IoT label

Everyone started taking the concept more seriously after Israeli startup Wiliot made significant strides to operationalize a label some years back, and much of big Pharma lined up to test the solution.

After understanding some of the limitations and nuances surrounding BLE stickers and gateways, we’re now looking at a scenario where Pharma is pumping their own dollars into development / co-development of a cellular-enabled label with their service providers. Many service providers are using this as a point of differentiation, despite almost every established, self-identifying ‘hardware provider’ being in this race.

And for good reason. Once we have a functional GxP validated label that can capture both location and condition of product, IoT hardware providers with no label are going to struggle to sell their clunky hardware at $30-$50 a pop. Cell-enabled labels at <$5/shipment would make real-time visibility economically viable on virtually every shipment.

There is, however, debate and lack of consensus surrounding the near-term technical viability in building and operationalizing a cellular-enabled label that will meet Pharmaceutical specifications.

FIVE: Generative AI experimentation has begun

At PAXAFE, we’ve been been building home-grown AI into our risk and prediction offerings since 2019.

We had realized that the volume of IoT data produced by one shipment paired with the amount of third-party data sources and ever-changing network variables makes it not viable or scalable to re-analyze and re-assess network risk on a recurring basis.

The challenge, for customers, has always been to decipher which service providers are actually building AI-enabled products versus those that say they are, but are not.

The perception of AI enabling a particular product, and that product falling short in its performance always holds a counterweight to expeditious investment and a default level of trust in AI products.

As a result, the opposite occurs: AI-enabled products are met with default skepticism that has to be converted to trust.

But Chat-GPT has demonstrated — on a much more human & tangible basis — that AI can be used to augment our own work, automate tedious tasks and query thoughtful and dynamic responses.

And Pharma is experimenting with generative AI tools and how they can make their daily work more effective.

At PAXAFE, we believe that the immediate case for generative-AI in Pharma logistics is two-fold:

1.) enable real-time querying of complex combinations of datasets across shipping networks to contextualize immediate responses that would negate the need to filter, sort or go analyze a dashboard

2.) assist with the generation of recommendation options and tradeoff scenarios in combination with other offerings (e.g. a risk scoring capability)

While these applications have a place in Pharmaceutical logistics, it will take time before Quality teams trust AI to actually automate GxP product quality decisions.

But in the meantime, at PAXAFE, we will continue to push the envelope on what is possible within AI-enabled cold chain logistics to help pharmaceutical companies automate their end-to-end supply chain network management.

ABOUT PAXAFE:

PAXAFE is the OS for visibility control towers. PAXAFE’s platform, CONTXT, is a device-agnostic, AI-enabled risk management platform that reduces product loss, improves operational efficiency and optimizes supply chain decision making.

PAXAFE’s mission is to unleash the value of supply chain visibility.

If you want to learn more, please reach out to ilya@paxafe.com